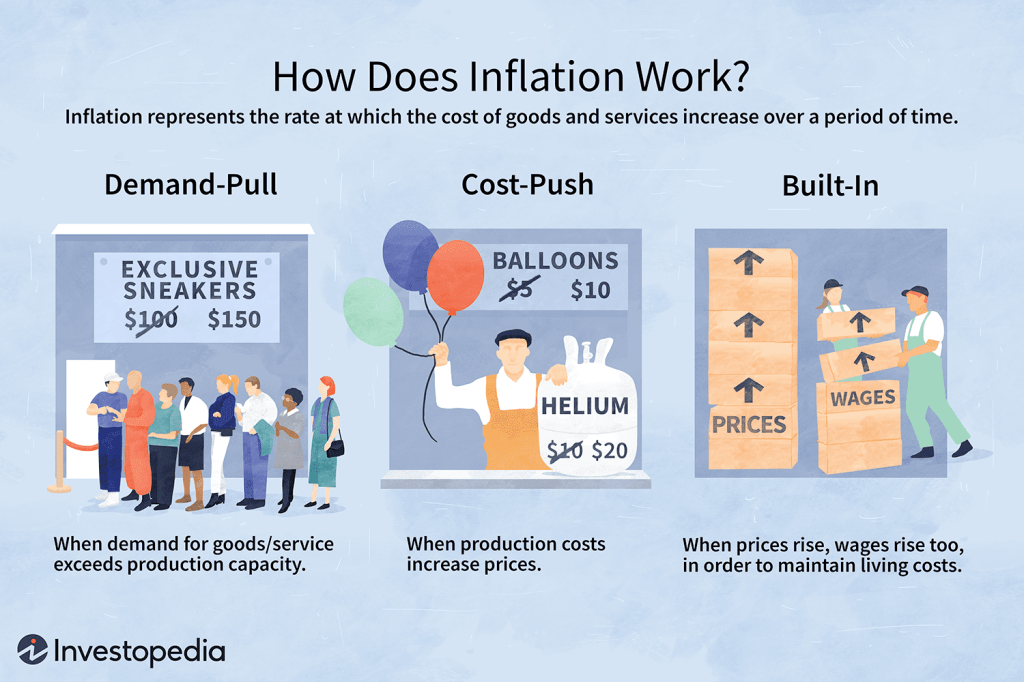

How does inflation work?

What are it’s causes?

How can you protect yourself from it?

Find out on the powerpoint presentation!

How does inflation work?

What are it’s causes?

How can you protect yourself from it?

Find out on the powerpoint presentation!

The principal investors in South Africa economy are South Africans. And this is something, I think, we should really pay attention to.

– Tahbo Mbeki

A general description

The South African economy is essentially based on private enterprise, but the state participates in many ways. Through the Industrial Development Corporation, the apartheid-era government set up and controlled a wide array of public corporations, many relating to industrial infrastructure. Two such corporations—one, the country’s primary producer of iron and steel; the other, an important producer of oil from coal—were privatized in the 1980s. The Electrical Supply Commission (ESKOM), the major electricity utility, remains government-controlled, but several entities that formerly were branches of government have been converted to public corporations, including Transnet, which runs the railways and harbours. In the 1990s the government partially privatized airlines and telecommunications, and, despite fierce opposition from trade unions, official economic policy has been to continue partially or completely privatizing many public enterprises.

Economic policy has been aimed primarily at sustaining growth and achieving a measure of industrial self-sufficiency. High rates of inflation and declining investment, however, have complicated the economic situation. Trade sanctions exacerbated these problems, but they continued even after the end of apartheid and sanctions. Dependence on imports renewed inflationary pressure while limiting the government’s ability to meet pressing social demands. Economic policy became the subject of ongoing debate between those favouring market forces and the advocates of substantial state intervention; still others favoured an export-led or inward-looking industrial policy.

Historically, the stated policy of the African National Congress (ANC), which took power in 1994, was that it would seek a state-led mixed economy based on nationalized mining and financial enterprises; since taking leadership of the government, it has in fact pursued privatization of a substantial number of formerly state-owned enterprises. The government faces competing demands—to improve the living conditions of the impoverished black population while also addressing the demands for economic liberalization from business interests and Western governments. It has chosen to make maintaining business confidence and boosting investment the core element of its economic policy.

South Africa is rich in a variety of minerals. In addition to diamonds and gold, the country also contains reserves of iron ore, platinum, manganese, chromium, copper, uranium, silver, beryllium, and titanium. No commercially exploitable deposits of petroleum have been found, but there are moderate quantities of natural gas located off the southern coast, and synthetic fuel is made from coal at two large plants in the provinces of Free State and Mpumalanga.

Coal is another of South Africa’s valuable mineral products. Large known deposits lie, mostly at easily mined depths, beneath the Mpumalanga and northern Free State Highveld. Coal is produced primarily for export (to East Asia and Europe) and for the generation of electricity.

South Africa is the world’s largest producer of platinum and chromium, which are mined at centres such as Rustenburg and Steelpoort in the northeast and are becoming increasingly significant economically. Vast deposits of platinum-group and chromium minerals are located mainly to the north of Pretoria. Northern Cape province contains most of the major deposits of iron ore and manganese, and titanium-bearing sands are common on the eastern seaboard. In addition, the country produces uranium, palladium, nickel, copper, antimony, vanadium, fluorspar, and limestone. Diamond mining, historically concentrated around Kimberley, now occurs in a variety of localities. The South African diamond industry, among the world’s largest, is largely controlled by De Beers Consolidated Mines, Ltd.

Agriculture is of major importance to South Africa. It produces a significant portion of exports and contributes greatly to the domestic economy, especially as an employer, though land and water resources are generally poor. Arable land constitutes only slightly more than one-tenth of the country’s surface area, with well-watered, fertile soils existing primarily in the Western Cape river valleys and on the KwaZulu-Natal coast. The Highveld of Mpumalanga and Free State historically has offered adequate conditions for extensive cereal cultivation based on substantial government extension services and subsidies to white farm owners. Some dry areas, such as in the Fish River valley of Eastern Cape province, have become productive through the use of irrigation. Further irrigation has been provided by the ongoing Orange River Project, which upon completion should add about another three-tenths to the total amount of land in production.

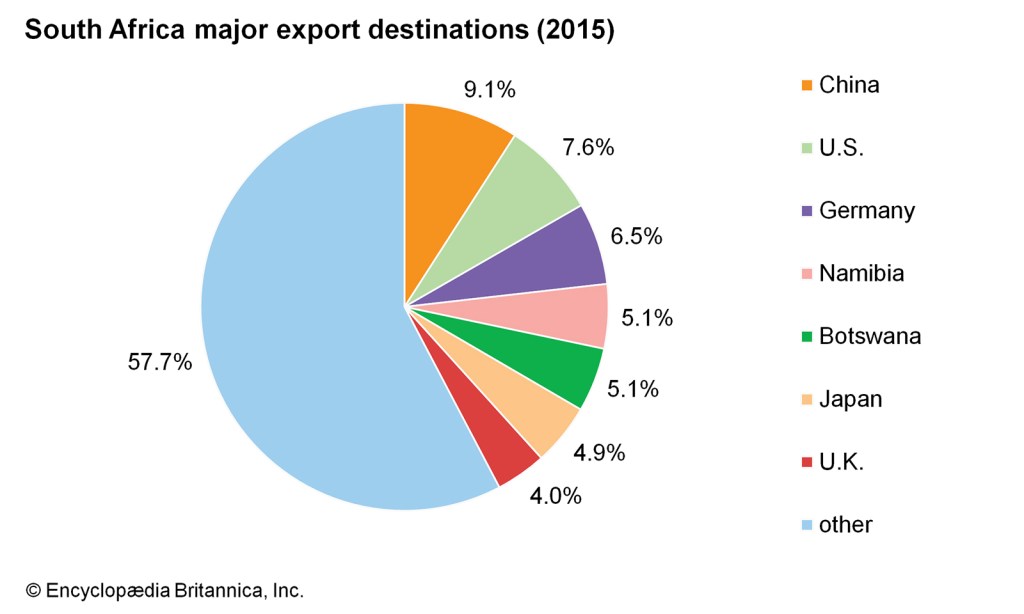

Because of its dependence on foreign trade, South Africa’s economy is sensitive to global economic conditions. Precious metals and base metals have been leading exports; agricultural goods and military equipment also play an important role. The country’s major imports are chemicals, chemical products, and motor vehicles. South Africa’s main trading partners include China, the United States, Germany, and Japan. Regional trade in Southern Africa is increasingly important, especially through the Southern African Development Community. Since the end of apartheid, South African companies have sought to expand investment in other African countries, particularly in mining and commercial activity.

https://prezi.com/view/mBQSTQFll6mqGEqPtVoD/

If you wanna know how it works in different parts of the world check this out!

A quick description of what social economy means, what are its main goals and what is the third sector!

The economy of China is a socialist market economy that ranks as the second largest in the world by nominal GDP and the largest in the world by purchasing power parity. China has the world’s fastest-growing major economy, with growth rates averaging 6% over 30 years. Due to historical and political conditions of China’s developing economy, China’s public sector accounts for a bigger share of the national economy than the burgeoning private sector. According to the IMF, on a per capita income basis, China ranked 73rd by GDP (PPP) per capita in 2019. The country has the world’s largest natural resources worth $23 trillion, 90% of which are coal and rare earth metals. China also has the world’s largest total banking sector assets of $39.93 trillion (268.76 trillion CNY) with $27.39 trillion in total deposits. It has the fourth-largest inward foreign direct investment, and the eleventh-largest outwardforeign direct investment. China has the world’s second-highest number of billionaires with total wealth of $996 billion. Of the world’s 500 largest companies, 129 are headquartered in China. It has the world’s largest foreign-exchange reserves worth $3.1 trillion. Historically China was one of the world’s foremost economic powers for most of the two millennia from the 1st until the 19th century.

China is the world’s largest producer and consumer of agricultural products – and some 300 million Chinese farm workers are in the industry, mostly laboring on pieces of land about the size of U.S farms. Virtually all arable land is used for food crops. China is the world’s largest producer of rice and is among the principal sources of wheat, corn (maize), tobacco, soybeans, potatoes, sorghum, peanuts, tea, millet, barley, oilseed, pork, and fish. Major non-food crops, including cotton, other fibers, and oilseeds, furnish China with a small proportion of its foreign trade revenue. Agricultural exports, such as vegetables and fruits, fish and shellfish, grain and meat products, are exported to Hong Kong. Yields are high because of intensive cultivation, for example, China’s cropland area is only 75% of the U.S. total, but China still produces about 30% more crops and livestock than the United States. China hopes to further increase agricultural production through improved plant stocks, fertilizers, and technology.

Though China has rich overall energy potential, most have yet to be developed. In addition, the geographical distribution of energy puts most of these resources relatively far from their major industrial users. Basically the northeast is rich in coal and oil, the central part of north China has abundant coal, and the southwest has immense hydroelectric potential. But the industrialized regions around Guangzhou and the Lower Yangtze region around Shanghai have too little energy, while there is relatively little heavy industry located near major energy resource areas other than in the southern part of the northeast.

Due in large part to environmental concerns, China has wanted to shift China’s current energy mix from a heavy reliance on coal, which accounts for 70–75% of China’s energy, toward greater reliance on oil, natural gas, renewable energy, and nuclear power. China has closed thousands of coal mines over the past five to ten years to cut overproduction. According to Chinese statistics, this has reduced coal production by over 25%.

The 11th Five-Year Program (2006–10), announced in 2005 and approved by the National People’s Congress in March 2006, called for greater energy conservation measures, including development of renewable energy sources and increased attention to environmental protection. Guidelines called for a 20% reduction in energy consumption per unit of GDP by 2010. Moving away from coal towards cleaner energy sources including oil, natural gas, renewable energy, and nuclear power is an important component of China’s development program. Beijing also intends to continue to improve energy efficiency and promote the use of clean coal technology. China has abundant hydroelectric resources; the Three Gorges Dam, for example, will have a total capacity of 18 gigawatts when fully on-line (projected for 2009). In addition, the share of electricity generated by nuclear power is projected to grow from 1% in 2000 to 5% in 2030. China’s renewable energy law, which went into effect in 2006, calls for 10% of its energy to come from renewable energy sources by 2020.

The output of China’s services in 2015 ranks second worldwide after the United States. High power and telecom density has ensured that the country has remained on a high-growth trajectory over the long term. In 2015 the services sector produced 52.9% of China’s annual GDP, second only to manufacturing. However, its proportion of GDP is still low compared to the ratio in more developed countries, and the agricultural sector still employs a larger workforce.

Prior to the onset of economic reforms in 1978, China’s services sector was characterized by state-operated shops, rationing, and regulated prices—with reform came private markets, individual entrepreneurs, and a commercial sector. The wholesale and retail trade has expanded quickly, with numerous shopping malls, retail shops, restaurant chains and hotels constructed in urban areas. Public administration remains a main component of the service sector, while tourism has become a significant factor in employment and a source of foreign exchange.[215]

China possesses a diversified communications system that links all parts of the country by Internet, telephone, telegraph, radio, and television. China’s number of Internet users or netizens topped 137 million by the end of 2006, an increase of 23.4% from a year before and 162 million by June 2007, making China the second-largest Internet user after the United States, according to China’s Ministry of Information Industry (MII). China’s mobile phone penetration rate was 34% in 2007. In 2006, mobile phone users sent 429 billion text messages (on average 967 text messages per user). For 2006, the number of fixed-lines grew by 79%, mainly in the rural areas.

China’s tourism industry is one of the fastest-growing industries in the national economy and is also one of the industries with a very distinct global competitive edge. According to the World Travel and Tourism Council, travel and tourism directly contributed CNY 1,362 billion (US$216 billion) to the Chinese economy (about 2.6% of GDP). In 2011, total international tourist arrivals was 58 million, and international tourism receipts were US$48 billion.

Domestic tourism market makes up more than 90% of the country’s tourism traffic, and contributes more than 70% of total tourism revenue. In 2002, domestic tourists reached 878 million and tourism revenue was $46.9 billion. A large middle class with strong consumption power is emerging in China, especially in major cities. China’s outbound tourists reached 20.22 million in 2003, overtaking Japan for the first time.

It is forecast by the World Tourism Organization that China’s tourism industry will take up to 8.6% of world market share to become the world’s top tourism industry by 2020.

Chinese business travel spending is also forecast to be the highest in the world by 2014, overtaking the United States. According to a Global Business Travel Association study, total business-travel spending is expected to reach US$195 billion in 2012.

It is forecast by Euromonitor International that China will overtake France as the leading travel destination by 2030.